How Insurance Companies Set Homeowner Rates

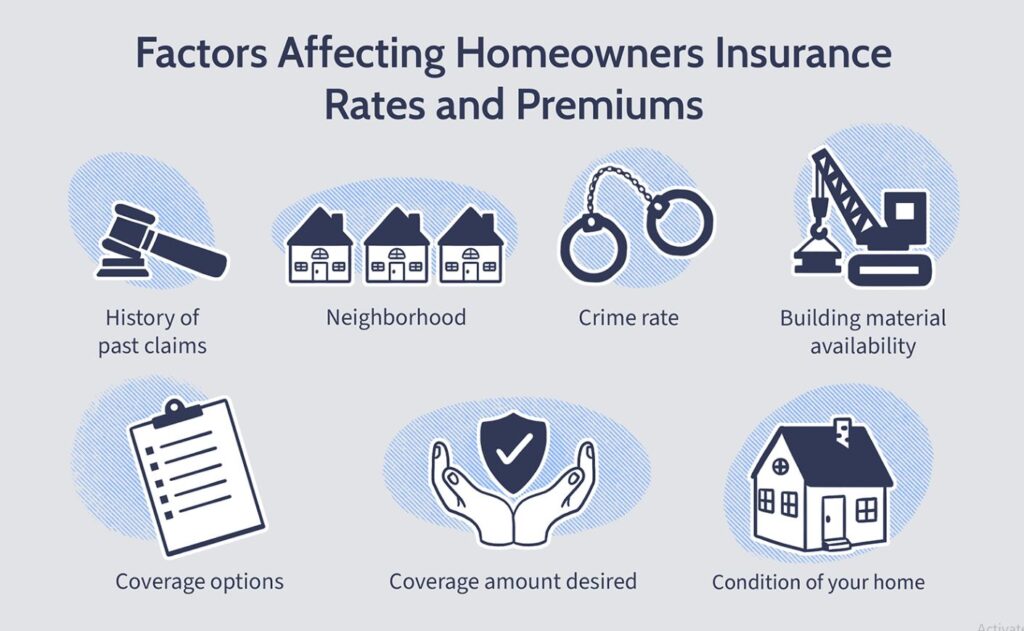

When it comes to protecting your most valuable asset—your home—homeowners insurance plays a critical role. But have you ever wondered how insurance companies determine your premium rates? Understanding the methodology behind homeowner insurance rate setting can empower you to make informed decisions, potentially lower your costs, and choose the best coverage for your needs. Below, we unveil the key variables that affect your premiums, based on the most current practices in the insurance industry.

Location: The Foundation of Home Insurance Premiums

One of the most influential factors in determining your homeowner’s insurance rate is your home’s geographic location. Insurers use detailed risk models to evaluate the potential hazards associated with your ZIP code, county, or even neighborhood.

- Natural disasters: Areas prone to earthquakes, hurricanes, wildfires, or floods tend to have higher insurance premiums. For instance, coastal homes are at greater risk of storm damage and require more expensive policies.

- Crime rates: A high incidence of burglary or vandalism in your area can raise premiums since these increase the likelihood of claims.

- Proximity to emergency services: Homes located close to fire stations or hydrants usually receive lower rates due to quicker emergency response times.

- Building codes and municipal infrastructure: Some cities have more stringent building regulations, which may influence the replacement cost and affect premiums.

Construction Materials and Home Characteristics

The materials and design of your house significantly affect its insurability and the premium you’ll pay.

- Wood-frame homes, while common, are more vulnerable to fire and pest damage, resulting in higher premiums.

- Brick, concrete, or masonry homes are generally more resistant to fire and storms, making them less expensive to insure.

- Age of the home: Older homes may have outdated electrical, plumbing, or roofing systems, increasing the likelihood of damage and insurance claims.

- Roofing material and condition: Homes with newer or impact-resistant roofs often qualify for lower rates because they reduce the risk of wind and hail damage.

Replacement Cost vs. Market Value

One critical element that many homeowners overlook is the difference between replacement cost and market value. Insurance companies typically calculate premiums based on the cost to rebuild your home, not its real estate price.

- Replacement cost refers to how much it would cost to rebuild the entire structure using similar materials and labor, often factoring in inflation and construction cost changes.

- Market value includes land cost and fluctuates with local real estate trends, which are not covered by homeowners insurance.

Failing to insure your home for the correct replacement cost may result in underinsurance penalties and out-of-pocket expenses in the event of a total loss.

Your Personal Claims History

Insurers assess your individual risk profile, and that includes your claims history. Even if a claim was legitimate and resolved fairly, it may still impact your future premiums.

- Frequent or recent claims—especially for water damage, fire, or liability—can mark you as a high-risk policyholder.

- Zero-dollar claims or inquiries without payouts may still be visible on your CLUE (Comprehensive Loss Underwriting Exchange) report and could influence rates.

- Multiple claims within a short period might not only raise premiums but could even lead to policy non-renewal.

Policy Coverage Limits and Deductibles

The level of coverage you select directly correlates with the amount you’ll pay in premiums.

- Higher coverage limits, including extended dwelling protection, personal property, and liability coverage, result in higher premiums.

- Choosing a lower deductible—the amount you pay out of pocket before insurance kicks in—also raises your premium. On the flip side, opting for a higher deductible can significantly reduce your rate.

- Optional endorsements or riders (such as flood insurance, sewer backup coverage, or valuable item protection) add tailored protection but increase total premium cost.

Credit-Based Insurance Score

Many insurers use a credit-based insurance score, which is different from your traditional credit score, to determine your likelihood of filing claims. This practice is permitted in many states, though some restrict or ban it.

- A higher credit score generally results in lower premiums, as insurers view financially responsible customers as lower risk.

- Poor credit may lead to increased premiums or limited coverage options.

To optimize your rate, it’s wise to maintain good financial habits, such as paying bills on time and reducing outstanding debt.

Discounts and Bundling Opportunities

Savvy homeowners can take advantage of numerous discount programs that help reduce insurance costs.

- Multi-policy discount: Bundling your home and auto insurance with the same provider often results in significant savings.

- Loyalty discounts: Some insurers reward long-term customers with premium reductions after several years of uninterrupted coverage.

- Home safety features: Installing smoke detectors, fire extinguishers, deadbolts, and security systems may qualify you for home protection discounts.

- Green home discounts: Environmentally friendly homes with energy-efficient systems or sustainable materials may qualify for lower premiums in select markets.

Home-Based Business and Liability Risk

If you operate a business from home, your insurer may need to adjust your policy to reflect the increased liability or property risks.

- Business equipment, clients visiting your home, and increased cyber liability all contribute to a different risk profile.

- Standard homeowner policies often exclude or limit coverage for commercial activity, requiring additional endorsements or even a separate business policy.

How to Lower Your Homeowner Insurance Premium

There are strategic steps homeowners can take to manage and lower their premium without sacrificing essential coverage:

- Conduct an annual policy review to make sure you’re not over-insured or missing out on new discounts.

- Upgrade your home with safety improvements like impact-resistant roofing, electrical rewiring, or foundation reinforcement.

- Avoid unnecessary small claims, which may have minimal payout but long-term impact on your insurability.

- Compare insurance quotes every few years to ensure your current provider remains competitive in pricing and service.

Conclusion

Understanding how insurance companies set homeowner rates allows you to make informed decisions that impact your financial protection. From geographic risks and construction materials to claims history and personal credit, every factor plays a role in the complex pricing models used by insurers. By being proactive—enhancing your home’s safety, reviewing your policy annually, and maintaining a clean claims history—you can secure comprehensive coverage at a competitive rate.

Choosing the right homeowner’s insurance isn’t just about price—it’s about knowing why you’re paying what you are and ensuring that your investment is properly protected for years to come.