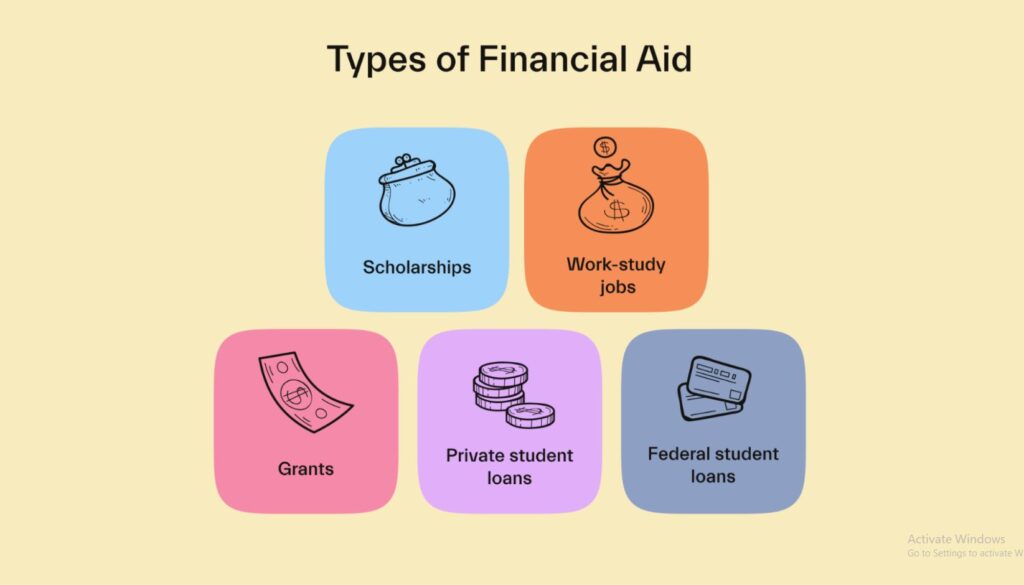

Types of Student Financial Aid

Pursuing higher education can be a life-changing investment, but it often comes with a significant financial burden. Fortunately, there are several types of student financial aid available to help cover the cost of tuition, books, housing, and other academic expenses. In this comprehensive guide, we explore the most common and beneficial forms of financial aid, including grants, scholarships, federal work-study programs, and student loans. Understanding each type is crucial for students and families seeking to fund a college, trade school, or career education.

Grants: Free Financial Aid That Usually Doesn’t Need Repayment

Grants are a vital form of need-based financial aid provided by the federal government, state agencies, colleges, and private organizations. Unlike loans, grants typically do not have to be repaid, making them one of the most sought-after types of financial support.

Federal Pell Grant

The Federal Pell Grant is the most widely awarded grant in the U.S. It is available to undergraduate students who demonstrate exceptional financial need and have not earned a bachelor’s, graduate, or professional degree. The maximum Pell Grant award amount can vary annually. To qualify, students must complete the Free Application for Federal Student Aid (FAFSA).

Federal Supplemental Educational Opportunity Grant (FSEOG)

The FSEOG provides additional aid to undergraduate students with exceptional financial need. Participating schools receive limited federal funds each year, so it’s crucial to apply early. Awards typically range between $100 and $4,000 annually, depending on availability and student need.

TEACH Grant

The Teacher Education Assistance for College and Higher Education (TEACH) Grant offers financial support to students planning to become teachers in high-need fields in low-income areas. Recipients must fulfill a service obligation, or the grant converts into a Direct Unsubsidized Loan with interest.

Scholarships: Merit-Based and Private Aid Options

Scholarships are another form of free money that does not require repayment. They are often awarded based on academic performance, athletic skill, artistic talent, leadership qualities, or financial need. Scholarships may come from colleges, nonprofit organizations, businesses, community groups, or private donors.

Institutional Scholarships

Many colleges and universities offer institutional scholarships to attract high-achieving students. These awards can cover a portion or the entirety of tuition and may be renewable each year based on GPA and academic progress.

Private Scholarships

Private scholarships vary widely in terms of eligibility, value, and application requirements. Students should search for opportunities through scholarship databases, community foundations, and industry-specific organizations. Many private scholarships require essays, recommendation letters, or proof of community involvement.

Field-Specific Scholarships

Some scholarships are targeted at students pursuing specific majors such as STEM, nursing, education, or business. Professional associations often offer such scholarships to encourage growth in their respective fields.

Federal Work-Study: Earn While You Learn

The Federal Work-Study Program provides part-time employment opportunities to students with financial need. This program allows students to earn money to pay for educational expenses while gaining valuable work experience, often in positions related to their course of study.

Eligibility and Application

To be considered for work-study, students must complete the FAFSA and indicate their interest in the program. Not all schools participate in federal work-study, so applicants should verify availability with their institution’s financial aid office.

Benefits of Work-Study

Students typically work between 10 to 20 hours per week in jobs on campus or with approved off-campus employers, such as nonprofits or public agencies. Pay is at least the federal minimum wage, and earnings do not significantly reduce eligibility for future aid.

Student Loans: Borrowing with Responsibility

When other forms of aid do not cover the full cost of education, student loans can help fill the gap. Loans must be repaid with interest, so it’s critical to understand the terms and borrow responsibly.

Federal Student Loans

Federal student loans are issued by the U.S. Department of Education and come with fixed interest rates and flexible repayment plans. There are several types:

- Direct Subsidized Loans: Available to undergraduate students with demonstrated financial need. The government pays the interest while the student is in school, during the grace period, and during deferment.

- Direct Unsubsidized Loans: Available to undergraduate and graduate students regardless of financial need. Interest accrues during all periods.

- Direct PLUS Loans: For graduate or professional students and parents of dependent undergraduates. A credit check is required, and interest begins accruing immediately.

- Direct Consolidation Loans: Allow borrowers to combine multiple federal student loans into one loan with a single monthly payment.

Private Student Loans

Private loans are offered by banks, credit unions, and private lenders. These loans often require a cosigner and have variable interest rates. They lack the flexible repayment protections of federal loans, so they should be considered a last resort after exhausting federal aid options.

How to Apply for Student Financial Aid

Applying for financial aid starts with submitting the Free Application for Federal Student Aid (FAFSA). The FAFSA is used to determine eligibility for federal grants, loans, work-study, and sometimes state or institutional aid.

Steps to Apply

- Gather Documents: Social Security number, tax returns, W-2s, bank statements, and records of untaxed income.

- Create an FSA ID: Both the student and a parent (if dependent) must create an FSA ID at studentaid.gov.

- Complete and Submit FAFSA: The earlier, the better. Some aid is distributed on a first-come, first-served basis.

- Review SAR (Student Aid Report): After submission, review the SAR for accuracy and make any necessary corrections.

- Monitor Award Letters: Once accepted to schools, students will receive financial aid award letters outlining available aid packages.

Maximizing Your Financial Aid Opportunities

Students can enhance their financial aid eligibility and minimize student loan debt by:

- Applying early and submitting the FAFSA as soon as possible after October 1st.

- Actively searching and applying for multiple scholarships.

- Meeting all deadlines and providing requested documentation promptly.

- Maintaining strong academic performance to retain merit-based aid.

- Consulting with a financial aid advisor for personalized assistance.

Conclusion

Understanding the types of student financial aid available is essential for making informed decisions about how to finance your education. From federal grants and merit-based scholarships to work-study programs and student loans, a strategic approach to financial aid can open doors to academic success and reduce the financial strain of higher education. Students should explore every available option and take full advantage of the resources offered through federal, state, institutional, and private sources. By making informed choices today, students can build a solid financial foundation for their educational and professional futures.