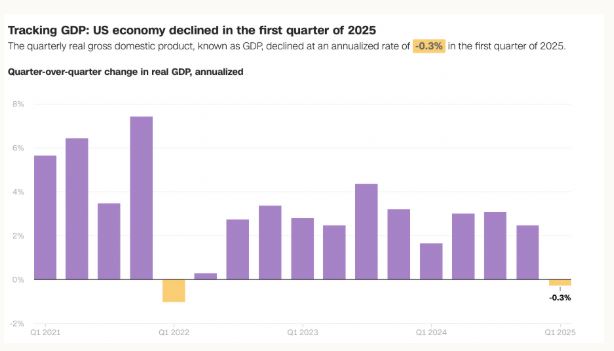

US Economy to Grow Negatively in Q1 2025 Amid Trade Deficit and Inflation Pressures

The United States economy contracted in the first quarter of 2025, marking the first negative growth period in over three years. According to the latest government data, gross domestic product (GDP) declined by 0.3%, a sharp reversal from the 2.4% growth recorded in the final quarter of 2024. The contraction not only fell short of economists’ expectations—who had forecast modest growth of 0.8%—but also exposed a range of structural and policy-driven challenges currently weighing on the nation’s economic momentum.

Sharp Surge in Imports Drives Record Trade Deficit

One of the most significant contributors to the economic downturn was the widening trade deficit, which reached its largest margin since 1947. In anticipation of new tariff measures implemented by the Trump administration in early April, both American consumers and businesses ramped up imports by a staggering 41.3% during Q1 2025. This strategic front-loading of foreign goods was aimed at avoiding higher costs once the tariffs took effect.

In stark contrast, exports grew by a mere 1.8%, creating an acute imbalance between outgoing and incoming trade volumes. The spike in imports without a proportional rise in exports dramatically eroded the GDP, underscoring the fragility of America’s current trade positioning.

Consumer Spending Slows Significantly

Consumer expenditure, the engine of the U.S. economy accounting for approximately 70% of GDP, witnessed a notable deceleration. Growth in consumer spending slowed to 1.8%, down from 4.0% in the previous quarter. The decline was largely concentrated in durable goods, including motor vehicles, recreational products, and household furnishings.

This reduction in discretionary spending reflects broader consumer caution, potentially driven by rising prices and uncertainty surrounding trade policies. As Americans tighten their budgets, the retail sector and manufacturing supply chains face downward pressure, creating ripple effects throughout the economy.

Federal Government Spending Declines

Another critical factor dragging on GDP was the contraction in federal government expenditure. Government spending dropped by 5.1% in Q1 2025, a sharp reversal from the 4% increase during the same period in 2024. The rollback in public sector investment likely stems from fiscal tightening initiatives aimed at curbing the national deficit.

While state and local government spending remained relatively stable, the substantial dip in federal allocations further reduced overall demand, particularly in sectors dependent on federal contracts and infrastructure development.

Inflation Accelerates, Dampening Real Growth

Compounding the economic slowdown is a surge in inflation, as indicated by the Personal Consumption Expenditures (PCE) Price Index, which rose to 3.6% in Q1 2025 from 2.4% the previous quarter. The increase in consumer prices has eroded real income gains, undermining purchasing power and creating significant headwinds for household consumption.

The elevated inflation levels are attributed to higher import costs, supply chain disruptions, and persistent wage inflation. With core inflation climbing steadily, the Federal Reserve may be pressured to consider additional monetary tightening, which could further suppress economic activity in the coming quarters.

Bright Spots: Business Investment and Labor Income

Despite the overall contraction, not all sectors of the economy suffered. Business investment recorded a surprising rebound, expanding by 9.8%, a strong recovery from the 3% decline in Q4 2024. This uptick in private fixed investment—including structures, equipment, and intellectual property products—suggests that companies are still willing to spend, particularly in forward-looking sectors such as technology and automation.

Moreover, the labor market provided modest reassurance. Personal income increased by 0.9% in January 2025, bolstered by cost-of-living adjustments for Social Security recipients and a 0.4% rise in wages. These gains helped sustain household disposable income, albeit under the strain of rising prices.

Implications for Future Quarters

The contraction in Q1 2025 is a stark reminder of the complex interplay between trade policies, consumer behavior, government spending, and inflationary trends. While temporary factors such as front-loaded imports and policy transitions have played a role, underlying issues—such as deteriorating trade balances and volatile price levels—point to deeper challenges ahead.

If inflation continues to accelerate and wage growth fails to keep pace, real consumer spending may weaken further. Similarly, unless export performance improves or import levels normalize, the trade deficit could persist as a major drag on GDP.

Risks of a Prolonged Downturn

Several risk factors now loom over the U.S. economic outlook:

- Trade Tensions: The ongoing shift in U.S. trade policy is likely to generate continued friction with key global partners, potentially leading to retaliatory measures and supply chain disruptions.

- Monetary Policy Uncertainty: With inflation rising, the Federal Reserve’s path remains unclear. Aggressive rate hikes could stifle investment and borrowing, while inaction risks entrenching inflationary pressures.

- Consumer Confidence Erosion: As households grapple with rising prices and slowing wage growth, consumer sentiment could erode, further weakening demand.

- Political Volatility: Upcoming elections and policy shifts may create additional uncertainty, impacting business planning and investor confidence.

Opportunities Amidst the Slowdown

Despite the grim headline numbers, certain sectors and trends offer strategic opportunities:

- Reshoring and Domestic Production: The emphasis on tariffs may accelerate onshoring strategies, with businesses investing more in domestic manufacturing capabilities.

- Green Energy and Infrastructure: Federal incentives in clean energy and public infrastructure could unlock significant investment flows, particularly if aligned with private capital.

- Digital Transformation: Continued investment in AI, automation, and cloud infrastructure is expected to drive long-term productivity gains, offsetting some short-term cyclical weakness.

Conclusion

The negative GDP growth in Q1 2025 serves as a critical juncture for the U.S. economy, revealing vulnerabilities in trade dynamics, consumer resilience, and inflation control. While there are bright spots in business investment and labor income, they are not yet strong enough to offset broader headwinds. The months ahead will require careful policy navigation, targeted stimulus, and robust coordination across public and private sectors to prevent further economic weakening.

Monitoring the evolution of trade balances, consumer sentiment, inflation trends, and federal fiscal strategies will be essential as we assess the trajectory of the U.S. economy throughout 2025. The path forward remains uncertain, but proactive measures can still mitigate long-term damage and lay the groundwork for sustainable recovery.